You Could Be Saving $US3,000 - $9,000 a Year With Home Based Business Tax Deductions

The value of home based business tax deductions is stated so well by Sandy Botkin:

“The light at the end of the tunnel… is the financial opportunity that starting your own business offers. Every North-American taxpayer who works a full-time job and does not have a side business is probably overpaying taxes to the tune of $3,000* to $9,000* a year!” —Sandy Botkin, former IRS tax attorney, CPA, founder of TRI

*U.S. dollars

That means that the average American family looses around 30% to social security taxes and could really benefit from some home based business tax deductions!

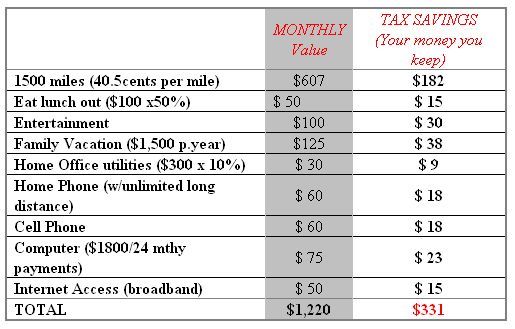

The importance of having a home book keeping system becomes apparent when you understand the value of home based business tax deductions. As an example of how you could be keeping more of your own money, take a look at this example of business expenses :

**This is illustration only,individual tax savings will vary with each individual. Consult your tax agent.

Does that make sense to why a home based business and the tax deductions are so important?

When you add to that the other benefits a home based business offers of:

- NO EMPLOYEES

- NO BOSS, NO SET HOURS,

- NO SET WORKPLACE

- HIGH INCOME POTENTIAL

- POTENTIAL TAX ADVANTAGES

It really is a question, well in my view, as to why wouldn’t you have a home business so you can get those home based business tax deductions? It's all about successful money management.

There are many other ways to legally get home business tax deductions in USA and also many home business tax savings here in Australia.. So make it your business to find out!

Is This You?

How I Can Hep

Successful Money Mangament

Return from home based business tax deductions page to Home Based Business home

U.S.A. | Canada | Australia | New Zealand | United Kingdom